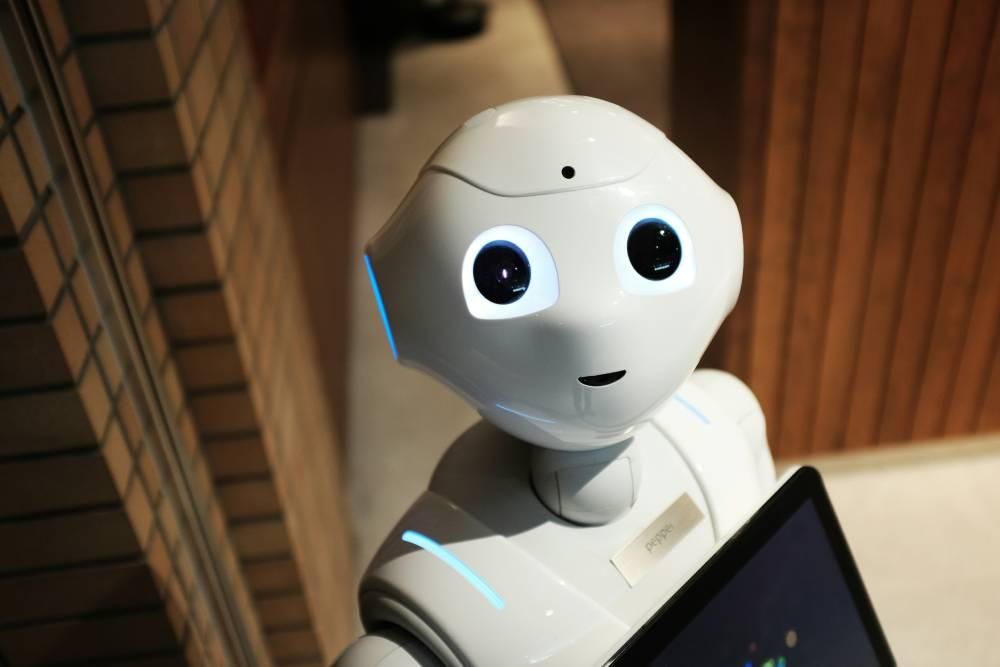

SoundHound, the AI company behind voice interfaces in automotive, restaurants, and tech, is doubling down on enterprise services by strengthening its position in the competitive AI market. Today, SoundHound announced it had acquired Amelia AI, a company that specializes in customizable AI agents for internal business ops and customer service. This move signals SoundHound’s expansion into the crowded AI services market.

About the Company

SoundHound AI, Inc. is a leading provider of artificial intelligence technologies for natural language processing and voice recognition. Founded in 2005 and based in Santa Clara, CA, the company is an AI pioneer. With a focus on innovation and customer success, SoundHound AI has developed a range of innovative solutions that help businesses unlock the power of AI and grow. SoundHound AI’s expertise in natural language processing allows it to create advanced voice interfaces for users across industries, including automotive, hospitality, and tech.

SoundHound buys Amelia AI for $80M

Expands Enterprise Footprint

SoundHound, a voice interface company, is making a big move to establish itself in the enterprise by buying Amelia AI for $80m in cash and equity. Amelia, with highly customizable AI agents, has big-name clients such as BNP Paribas, Teva Pharmaceuticals, and Fujitsu. This acquisition allows SoundHound to diversify and expand its customer base, which previously was focused on automotive, restaurants, and tech companies. With Amelia, SoundHound is entering new verticals such as financial services, insurance, healthcare, retail, and hospitality, where it has a limited presence.

About Amelia AI

Founded in 1998 as IPsoft, Amelia AI has been an AI pioneer for enterprise solutions. Its focus on creating AI agents for both customer service and internal business ops has made it a valuable asset for big companies. Amelia has raised at least $189m in funding, including a $175m investment from BuildGroup in March 2023. Its pre-acquisition valuation is unknown, but Amelia is a well-known player in the AI space. Its founder and current CEO, Chetan Dube, has navigated the company through several technological waves, from the early internet boom to the current AI era.

Growth Acceleration

This acquisition will boost SoundHound’s market presence and revenue. The two companies will serve around 200 clients, including top-tier banks and Fortune 500 companies, expanding SoundHound’s addressable market. SoundHound expects $150m in revenue by 2025, with $45m of that coming from Amelia’s current business lines.

For SoundHound, this is a key step in expanding its enterprise services. Historically focused on voice AI solutions for automotive manufacturers, tech companies, and restaurants, the company will now be able to offer advanced AI solutions to industries like finance, healthcare, and retail, which are increasingly using AI for operational efficiency and customer interaction. Amelia’s AI agents, customizable for internal ops and customer-facing needs, will open up new revenue streams and make SoundHound a full-stack AI solutions provider.

Challenges and Market Leadership

SoundHound AI’s stock is looking good at $9.31. Over the last week, the company’s market cap has increased by 9.75%, and the stock has increased by 26.67%. This is a vote of confidence from investors and the company’s market position. Over the last 12 months, SoundHound AI’s market cap has increased by 304.78%, making it one of the top-performing stocks in the AI space. This is a result of the company executing its strategy and riding the AI wave.

SoundHound acquired Amelia at a critical time for the company. After going public via an SPAC merger in 2021 at a $2.1 b valuation, SoundHound had a rough 2023. The company laid off almost 50% of its workforce and was looking for more funding to get back on its feet. At its lowest point in January 2023, the company’s market cap was below $300m. But the company has recovered strongly, and as of 2024, the market cap is around $1.4b, a sign of renewed investor confidence.

Despite this, SoundHound will still be loss-making. However, with the acquisition of Amelia and recent funding, the company is set for long-term growth. Amelia’s large customer base and AI expertise will allow SoundHound to scale further and become more profitable in the future.

Financial Impact of Acquisition

SoundHound AI has received funding from investors, a sign of strong market demand. The company has a market cap of $3.44 billion and a big market presence. In the last quarter, SoundHound AI reported $25.09m in gross profit, not bad. There was $-80.16m in free cash flow, but net income has been improving, currently $-21.75m. This shows that SoundHound AI can generate revenue and manage its resources well, which is set for growth.

As part of the deal, SoundHound will pay $80 million and assume some of Amelia’s debt. Once the deal closes, the combined company will have $160m in cash and $39m in debt. This will be used to accelerate product development and hire more people to support the growing enterprise customer base.

Partnerships and AI

A key to SoundHound’s success in developing and running its AI models has been its partnerships with major cloud providers, including Google Cloud. These partnerships give access to GPU and TPU clusters, which are critical for training and deploying AI at scale. This computing power allows SoundHound to optimize its AI models for real-time interactions, especially in automotive and voice interfaces. However, while SoundHound benefits from these partnerships, the company clarified that its AI models are not trained on YouTube videos despite being a Google Cloud partner. Instead, it uses other data sources to fine-tune its AI models and make its voice interface solutions more realistic and usable.

Forward: A Unified AI for Enterprise

Both SoundHound and Amelia have a long history in AI. SoundHound was founded in 2005, and Amelia (as IPsoft) in 1998. Together, they bring decades of experience and innovation. The acquisition of Amelia adds new capabilities and more services to offer enterprise customers. With Amelia’s AI agent technology and SoundHound’s voice interface expertise, the combined company will be a leader in AI for enterprises across multiple industries.

Going forward, SoundHound will integrate Amelia’s AI capabilities to offer more comprehensive and customizable AI solutions to businesses. By combining the strengths of both companies, SoundHound will offer end-to-end AI services, from voice interfaces to AI-driven customer service agents, and be a one-stop shop for businesses looking to modernize with AI.

SoundHound’s Acquisition of Amelia AI: Enterprise Integration

Navigating Complex Integration for Regulated Customers

SoundHound’s acquisition of Amelia AI is an accelerant for getting into highly regulated industries. According to SoundHound’s co-founder and CEO, Keyvan Mohajer, some of Amelia’s customers are in complex, highly regulated environments, and integrating AI solutions into these sectors requires a lot of time and expertise. “Incubating these types of relationships and developing the associated product capabilities would take us years, so this is an accelerant for us,” Mohajer said. By acquiring Amelia, SoundHound gets not only the technology but also the customer base and expertise to navigate complex compliance requirements.

Since SoundHound is voice interface-focused, Amelia’s voice assistant capabilities give SoundHound an additional way to enter new industries where Amelia already has relationships, especially in finance, healthcare, and insurance, where compliance is key.

The Gap in Amelia’s Valuation: A Deal for Both

The $80m cash and equity deal for Amelia AI is notable, given Amelia had raised at least $189m in funding, with $175m of that in March 2023. When asked about the large gap between what Amelia raised and the sale price, Mohajer declined to comment on the valuation difference. But he said the deal makes sense for both parties. “We are happy to have acquired Amelia at a price that works for both our companies. We agree on the combined upside,” Mohajer said. He added that Amelia has a strong product portfolio and a great customer base, which SoundHound will use to grow the business.

The AI Bubble?

The deal comes at the height of the AI investment and growth wave, with over $35b invested in AI startups in the first half of 2024 alone. 28 AI startups have raised over $100m this year, and projections have businesses spending $1 trillion in AI-related capex in the next few years, according to Goldman Sachs.

Despite all this capital flowing in, some industry experts are starting to wonder if the AI market is over-inflated. The gap between what Amelia raised and the sale price has raised questions about M&A deals undervaluing the AI space compared to what startups are growing. But Mohajer is not concerned. “Some are speculating we are seeing over-investment in companies building foundation models. But foundation models are just the beginning. We believe there will be a long-lasting wave of value creation for companies that build and scale businesses around AI, and that’s exactly what we are doing here,” he said, reiterating SoundHound’s view on the long-term value of AI businesses.

A Series of Strategic Deals

SoundHound’s acquisition of Amelia is part of a larger strategy of acquiring businesses to grow the company. Earlier in 2024, SoundHound acquired Allset, a Ukrainian-founded restaurant ordering platform, another AI-driven solution to add to the portfolio. Prior to that, SoundHound bought SYNQ3, an AI provider for restaurants, for $25m in December 2023. These deals demonstrate SoundHound’s interest in growing in service-based AI applications, especially in industries where voice and automation are key.

Mohajer is interested in building the foundation for AI and practical customer-facing applications that integrate AI into daily business operations. “We have a great portfolio, and we are scaling production of our conversational and generative AI solutions with innovation and risk management of hallucination,” Mohajer said. He said the big opportunity is to get AI into more ecosystems to make end customers more productive, not just build tech.

What’s Next for Service-Based AI?

As the AI landscape unfolds, companies like SoundHound are betting on service-based AI businesses where AI is not just a back-end tool but a front-end solution for real-world applications. The success of these businesses will depend on how well they can deliver tangible value to customers by making them more productive, automating tasks, and enhancing user experience across industries. With its growing portfolio of AI-driven solutions and strategic deals, SoundHound is positioning itself as a leader in this space, innovating in voice interfaces and integrated AI ecosystems.

As the AI market grows, we will see how companies like SoundHound balance building foundation models with real-world applications that meet the needs of industries like healthcare, finance, and hospitality. For now, SoundHound’s deal with Amelia and previous deals mean they are ready to go big and deliver more AI-powered solutions to more customers.